RWI/ISL Container Throughput Input Index

US customs policy shows first effects

25.04.2025

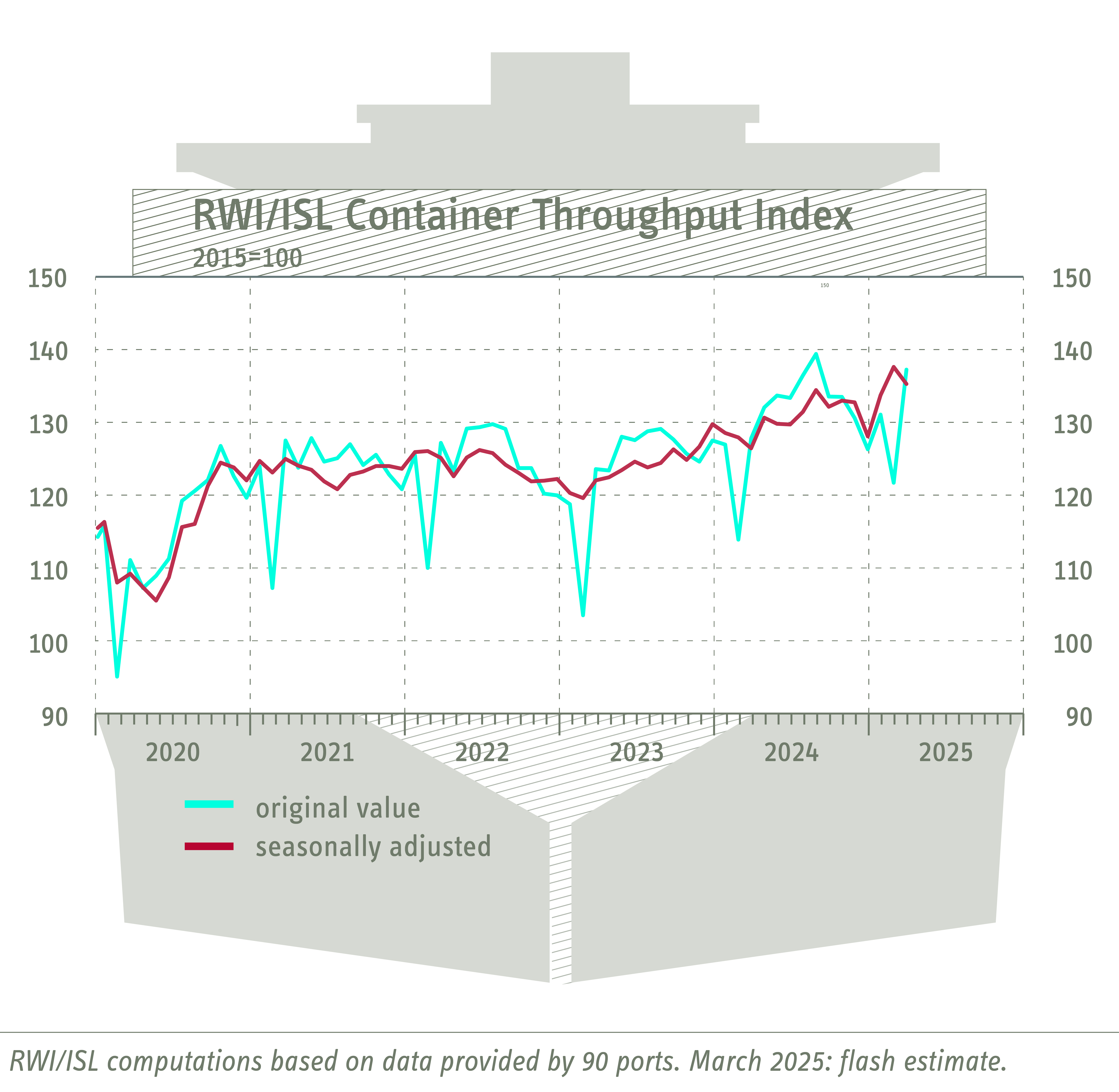

According to the latest flash estimate, the Container Throughput Index of the RWI - Leibniz Institute for Economic Research and the Institute of Shipping Economics and Logistics (ISL) fell to a seasonally adjusted 135.3 points in March compared to 137.6 points (revised) in the previous month. After container throughput in European ports had already fallen in the previous month, shipping trade is now declining in almost all regions of the world.

The essence in a nutshell:

- The seasonally adjusted Container Throughput Index of the RWI - Leibniz Institute for Economic Research and the Institute of Shipping Economics and Logistics (ISL) fell to 135.3 points in March compared to 137.6 points (revised) in the previous month.

- The North Range Index, which provides an indication of economic development in the northern eurozone and Germany, fell from 112.8 (revised) to 112.1 points in March compared to the previous month.

- In the Chinese ports, container throughput fell to 154.8 points compared to 157.8 points (revised) in the previous month.

- The RWI/ISL Container Throughput Index for April 2025 will be published on 28. May 2025.

Torsten Schmidt

Sönke Maatsch

About the RWI/ISL- Container Throughput Index

The index takes into account container throughput data continuously collected on an ongoing basis by the ISL Monthly Container Port Monitor at 90 international ports, representing approximately 64% of global container throughput. The present flash estimate for the Container Throughput Index relies on data representing approximately 67% of the throughput represented in the index. Since international trade is mainly handles by sea, the development of container throughput provides reliable insights into global merchandise trade. As many ports already report their data a fortnight after the end of each month, the RWI/ISL Container Throughput Index is a reliable early indicator of the international merchandise trade and hence also of global economic activity.

The Container Troughput Index is used by many international bodies such as UNCTAD and is included in the Shipping/Port Data section of the WTO’s Global Trade Data Portal.

Data series for individual ports are available in the ISL Monthly Container Port Monitor.