SSMR Vol. 07: Shipyards are booked out

Shipyards are fully booked. According to CRSL, the global order book has stabilized during the first half of 2025 at a high level: at the beginning of July, 5,695 ships with a capacity of 381 million dwt and a CGT of 157.1 million were in the order books of shipyards worldwide.

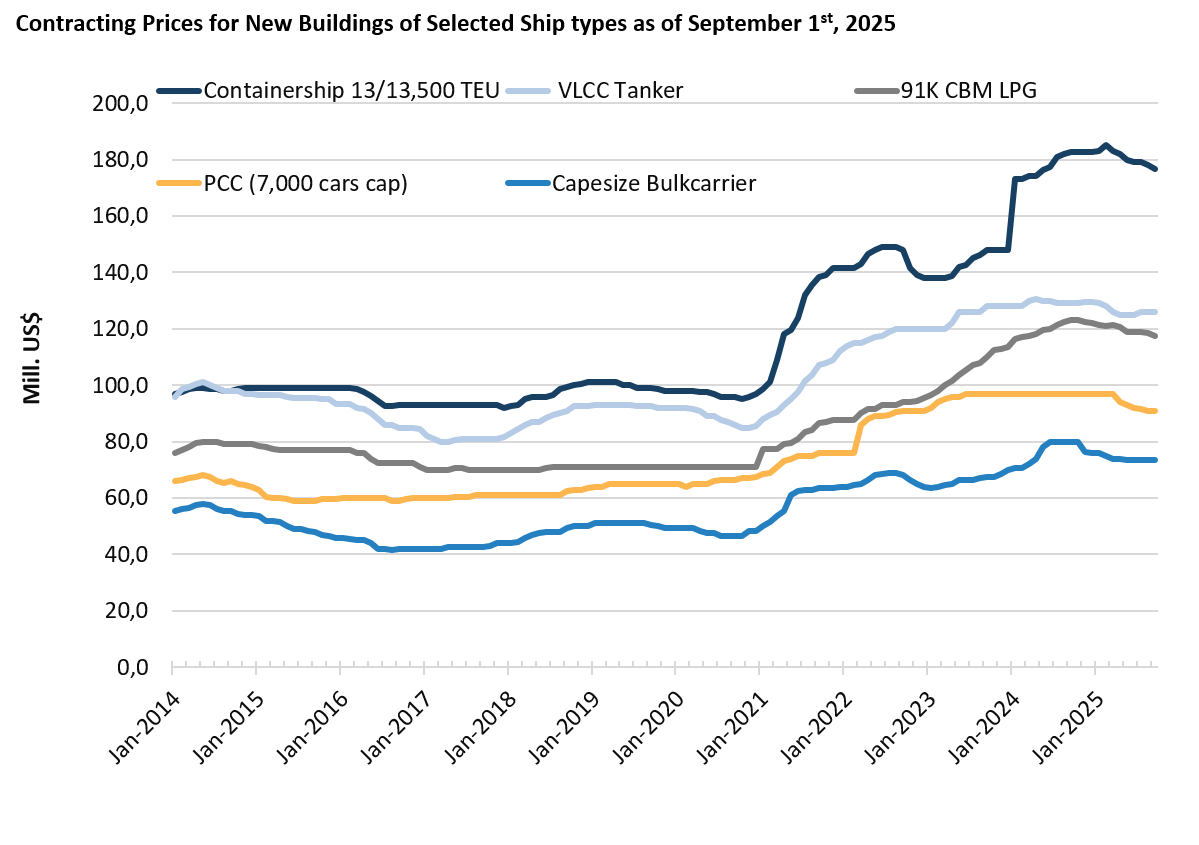

With a 6.5% increase in orders (measured in dwt) compared to January 1st of this year, the period of double-digit growth rates is over for now. In addition to an uncertain global economic situation, however, the utilization of capacity at the large shipyards in Northeast Asia is also responsible for the significant decline in newbuilding orders (-43% in the first half of 2025 compared to the second half of the previous year).

As of July 1st this year, the total order volume amounted to 16 percent in relation to the existing fleet capacity measured in dwt, up from 12.7 percent in mid-2024 and just 8 percent five years ago. This figure is thus almost back to the level of 10 years ago, when the order volume represented 17.2% of the fleet.

Of the approximately 601 newbuilding orders in the first half of 2025 (18.6 million cgt), more than half (51% cgt) went to shipyards in the PRC. 26% to South Korea and – already at a distance – to Japan with 6.6%, measured in cgt. The share of European shipbuilders in the global market has recovered to some extent and now stands at 11.6%

Asian shipyards are benefitting from the boom in the container and gas tanker segments. The majority of the new orders during the first half of 2025 were for container vessels (cgt-share 46.8%) and, in approximately equal proportions, bulk carriers (9%), liquefied gas tankers (also 9%) and crude oil and product tankers (9.5%), while ship owners’ interest in new cruise ships was very low. Only 22 new passenger ships with an order volume of 2.0 million cgt were ordered this year, which is more or less the same level as in the same period last year.

With regard to general cargo ships, this year was the first time ever that neither ro-ro ships nor car carriers were ordered within a quarter, whereas in the past year 2024, 23 ro-ro ships with 130,000 cgt and even 74 car carriers with 2.3 million cgt were ordered. Nevertheless, the order backlog remains very high, particularly for car carriers, at 6.1 million cgt, which is 15 times higher than five years ago.

The order book for new bulk carriers remains unchanged at a record level, even though the number of new orders this year has fallen by more than half compared to 2024. As of July 1st this year, CRSL reports a record order volume for this ship type of 1,235 units with a transport capacity of more than 100 million dwt.

The ISL SSMR 2025-7 looks at different developments around shipbuilding; The issue is currently being sent to subscribers and can be ordered via our web shop.

Further Information

ISL Webshop: order current SSMR issue

The ISL SSMR 2025-7 highlights the different developments around shipbuilding and can be ordered through the ISL webshop.

The special feature topics of each SSMR issue are:

- Issue 1: World Merchant Fleet

- Issue 2: Tanker Market

- Issue 3: Bulk Carrier Market

- Issue 4: Container Shipping

- Issue 5: General Cargo and Container Shipping

- Issue 6: Passenger and Cruise Shipping

- Issue 7: Shipbuilding and Shipbuilders

- Issue 8: Major Shipping Nations

- Issue 9: World Seaborne Trade and World Port Traffic