SSMR Vol. 02: Secondhand market for tanker is stabilizing on a very high level

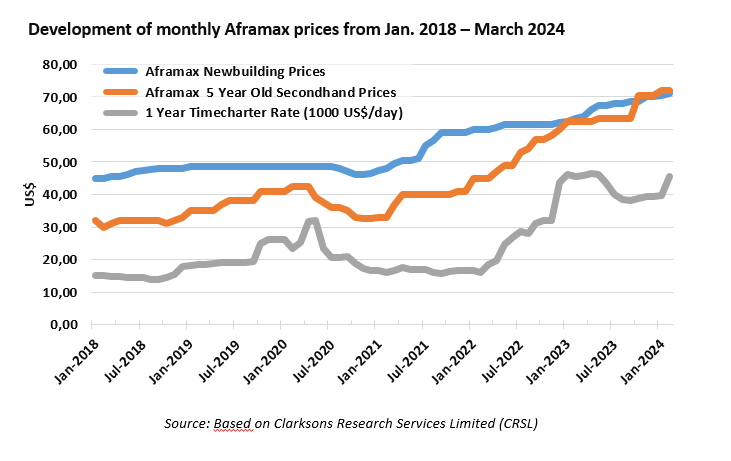

Besides the sharp rise in raw material prices and transport costs, current geopolitical developments also have a major influence on the development of prices in the newbuilding sector and in the second-hand vessel market. Here, the price developments are particularly impressive and have led to the fact that currently (Jan. 2024), a 5-year-old Aframax tanker with a price tag of US$ 72 million is trading at a higher price than a newbuilding order in the same size class (US$ 68.5 million). The development of the prices for used ships in the oil as well as in the LNG sector went steeply upwards in the last two years. However, the second-hand market currently stagnates on a very high level. As the transport capacities of the tanker fleet are currently in high demand, the scrapping figures are also declining again after a high in the middle of last year, and scrap prices are rising again.

According to CRSL, newbuilding prices for a 147,000 m3 LNG carrier have risen from US$ 248 million in early 2023 to US$ 265 million in January 2024. Secondhand prices in the LNG sector have risen moderately in the past year. For example, US$ 200 million had to be invested for a 5-year-old 160k m3 tanker at the beginning of 2023, and US$ 215 million in January 2024, representing a price increase of 7.5 %. However, the market seems to be slowly calming down in this sector as well (albeit at a high level), as prices have remained at this level for 3 months now. Investment in new LNG carrier construction amounted to USD 15.8 billion in 2023, more than any other shipping sector.

Thanks to the very good market development in the tanker shipping sector, stagnating scrap prices at a high level and the high demand for transport capacity, only 28 crude oil and product tankers and 10 chemical tankers were scrapped last year. This corresponds to the lowest demolition volumes in more than 25 years. Compared to last year, the demolition volume fell by 77 %. In addition, there were only 0.2 million dwt of scrapped oil/chemical tanker tonnage in 2023.

The ISL SSMR 2024-2 highlights various developments surrounding the major tanker markets and is available via our Webshop and has just been sent to subscribers.

Further Information

ISL Webshop: order current SSMR issue

The facts outlined above and many more details about the world maritime trade and the development of the ports involved can be found in the current issue of our SSMR.

The special feature topics of each SSMR issue are:

- Issue 1: World Merchant Fleet

- Issue 2: Tanker Market

- Issue 3: Bulk Carrier Market

- Issue 4: Container Shipping

- Issue 5: General Cargo and Container Shipping

- Issue 6: Passenger and Cruise Shipping

- Issue 7: Shipbuilding and Shipbuilders

- Issue 8: Major Shipping Nations

- Issue 9: World Seaborne Trade and World Port Traffic