SSMR Vol. 04: World Container Shipping - Shrinking, but still high order backlog

The boom in the container sector with rising charter and freight revenues was reflected in order activity in 2021. The exceptional order volume in 2021 has led to wave of deliveries that set in during 2023.

At the start of 2024, the order book amounted to 837 container vessels of 6.9 million TEU, down 6.9% since the start of 2023. Megamax vessels of 22,000 TEU and above will not account for the majority of capacity entering service by 2025, but the Neo-Panamax class (~10,000-16,000 TEU) with approx. 3.8 million TEU. It is noteworthy that only ships of 22,000 TEU or more were ordered in the ULCV segment with no orders in the previously popular 18,000-22,000 TEU size class.

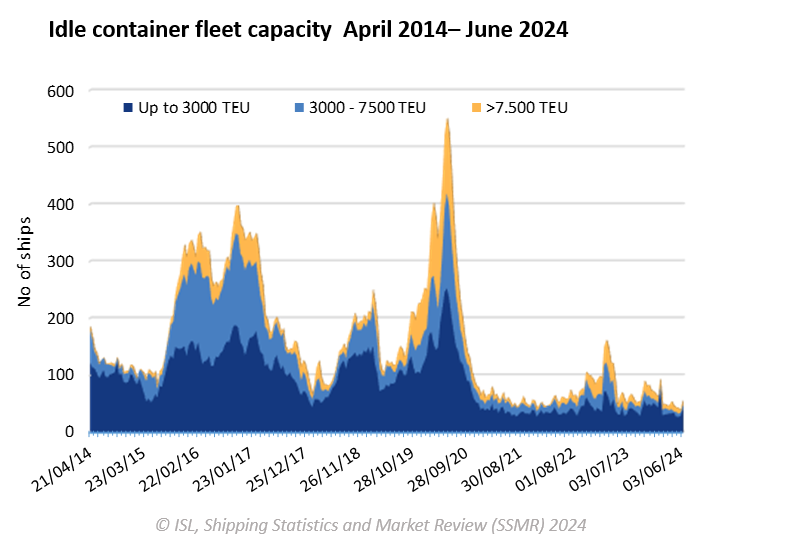

The enormous increase in tonnage delivered in 2023 is also reflected in the recent number of laid-up units. According to May 2024 data from Alphaliner, mainly ships in the feeder sector have been temporarily withdrawn from service, which confirms that the employment of larger vessels was pushed by events like the deviation of Europe-Asia services and the reduced capacity of the Panama Canal.

According to latest data from ISL’s Port Database , global container traffic was stagnating in 2023. In total, the container ports included in the database handled 733.6 million TEU in 2023, just 300,000 more than in 2022. By far the highest growth among all top 20 ports was achieved by the port of Tanger in Morocco. It is the first African port to enter the top 20. With a staggering annual average growth rate of 19.9% between 2018 and 2023, the port more than doubled its container handling volume within five years.

After a year of strong regional growth disparities, 2024 started with a much more balanced growth. According data from ISL’s Monthly Container Port Monitor for Q1 2024, container traffic grew in all major port regions except for the Near and Middle East. The American markets bounced back strongly which may in part be related to an easing of the situation at the Panama Canal. Europe shows moderate growth compared with the first quarter of 2023 and so do most Asian markets. According to the RWI/ISL Container Throughput Index for May 2024, this trend continued during spring.

ISL SSMR 2024-4 highlights the current developments around container shipping. It is available via download from our webshop and will be sent to our subscribers shortly.

Further Information

ISL Webshop: order current SSMR issue

ISL SSMR 2024-4 deals with the order books of the world container shipping industry. The issue is currently being sent to subscribers and can be ordered via our webshop.

The special feature topics of each SSMR issue are:

- Issue 1: World Merchant Fleet

- Issue 2: Tanker Market

- Issue 3: Bulk Carrier Market

- Issue 4: Container Shipping

- Issue 5: General Cargo and Container Shipping

- Issue 6: Passenger and Cruise Shipping

- Issue 7: Shipbuilding and Shipbuilders

- Issue 8: Major Shipping Nations

- Issue 9: World Seaborne Trade and World Port Traffic