SSMR Vol. 02: The huge capacity surplus has pushed LNG charter rates to a record low

The gas carrier sector showed another strong fleet expansion in 2024. The global gas tanker fleet at the start of 2025 comprised 2,466 carriers with a combined 171 mcbm capacity. The fleet consisted of 1,662 LPG carriers totalling 49.5 mcbm and 804 LNG units with around 121 mcbm.

In 2024, 67 carriers of a combined 10.3 mcbm have been delivered to the LNG fleet, representing a 81.1 % year-on-year capacity increase. Within the last ten years, the total fleet capacity has doubled.

According to CRSL, 93 LNG tankers with a capacity of 16.0 mcbm and 146 LPG carriers totalling 9.9 mcbm were reported as newbuilding orders in the full year 2024. This corresponds to an impressive increase in new construction orders by 41.1% (LNG) and 23.9% (LPG) compared with 2023.

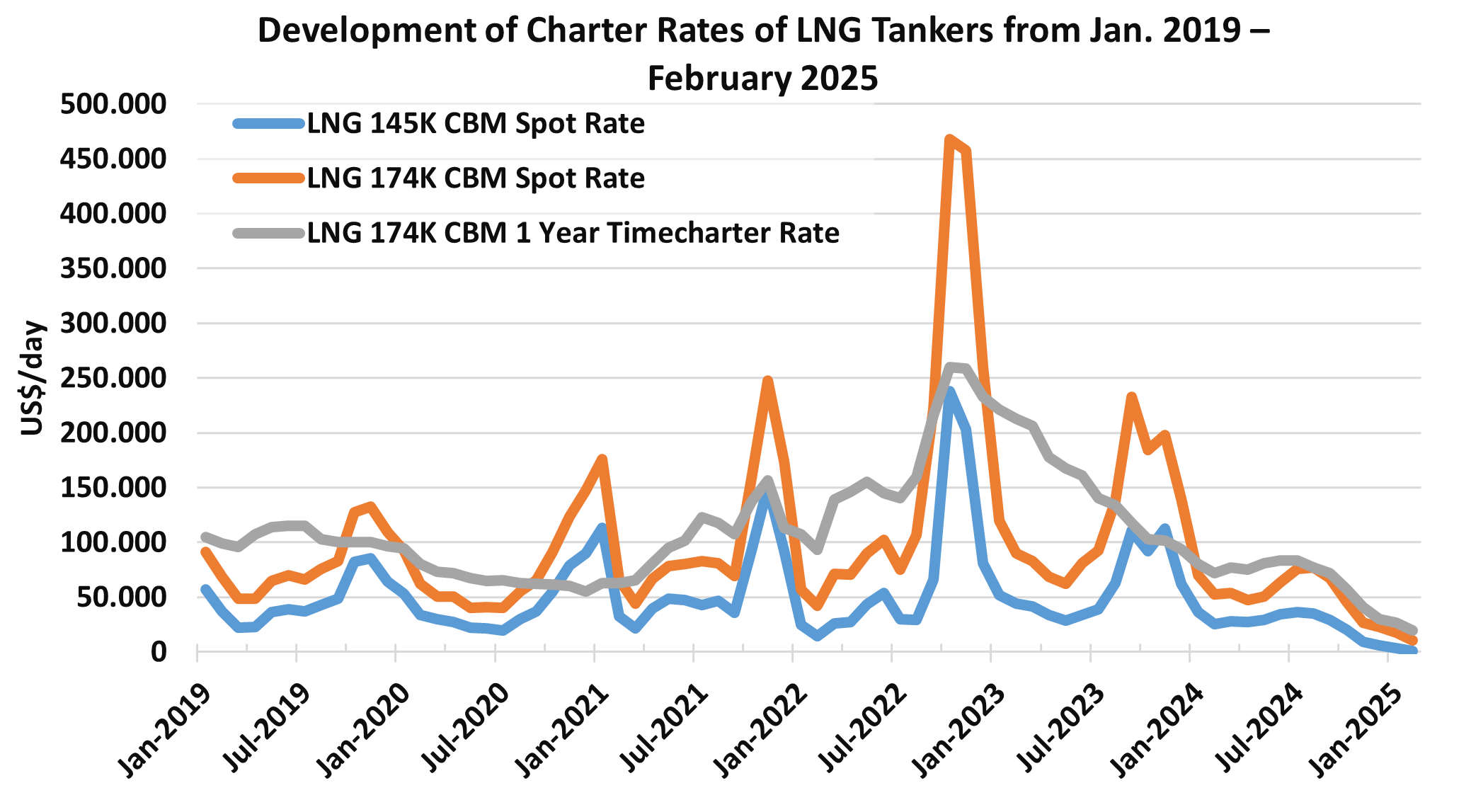

Spot LNG charter rates have fallen by more than 75% between January, 1st 2024 and 2025 in the most important trades and are thus at a level that is not sufficient to cover operating costs. LNG time-charter rates have also fallen sharply since the end of 2022, dropping from just over USD 210,000/day to an average of around USD 15,000/day at the beginning of this year.

The main reason for this is the massive surplus of LNG transport capacity. The continued strong growth of the global gas tanker fleet (up 7.2% this year after 6.7% in the previous year) significantly exceeded the rather limited growth in LNG seaborne trade in the last 2-3 years (up 1.9% from 2023 to 2024 and an estimated 4.2% from 2024 to 2025), which exerted strong downward pressure on charter rates despite longer trade routes (due to problems in the Panama Canal and the Middle East, among others).

The capacity overhang will continue to worsen in the current year and beyond, as a high number of deliveries in the gas tanker segment can also be expected in 2025 and the order backlog remains high.

In this year alone, 162 gas tankers with a total transport volume of over 20 million cubic meters will be delivered. According to the current delivery schedules, another 182 and 216 ships with 21.3 and 24.2 million cubic meters will be added in 2026 and 2027, respectively.

The ISL SSMR 2025-2 highlights various developments surrounding the major tanker markets and is available via our Webshop and has just been sent to subscribers.

Further Information

ISL Webshop: order current SSMR issue

The ISL SSMR 2025-2 highlights various developments surrounding the major tanker markets and can be ordered through the ISL webshop.

The special feature topics of each SSMR issue are:

- Issue 1: World Merchant Fleet

- Issue 2: Tanker Market

- Issue 3: Bulk Carrier Market

- Issue 4: Container Shipping

- Issue 5: General Cargo and Container Shipping

- Issue 6: Passenger and Cruise Shipping

- Issue 7: Shipbuilding and Shipbuilders

- Issue 8: Major Shipping Nations

- Issue 9: World Seaborne Trade and World Port Traffic