SSMR Vol. 05: Car handling in ports on constantly high levels

The monthly car throughput figures in the early part of this year confirm the trend that had already become apparent in mid-2021. Since the beginning of 2022, the monthly throughput figures in the ports monitored by ISL have remained between 1.6 million and 2 million vehicles.

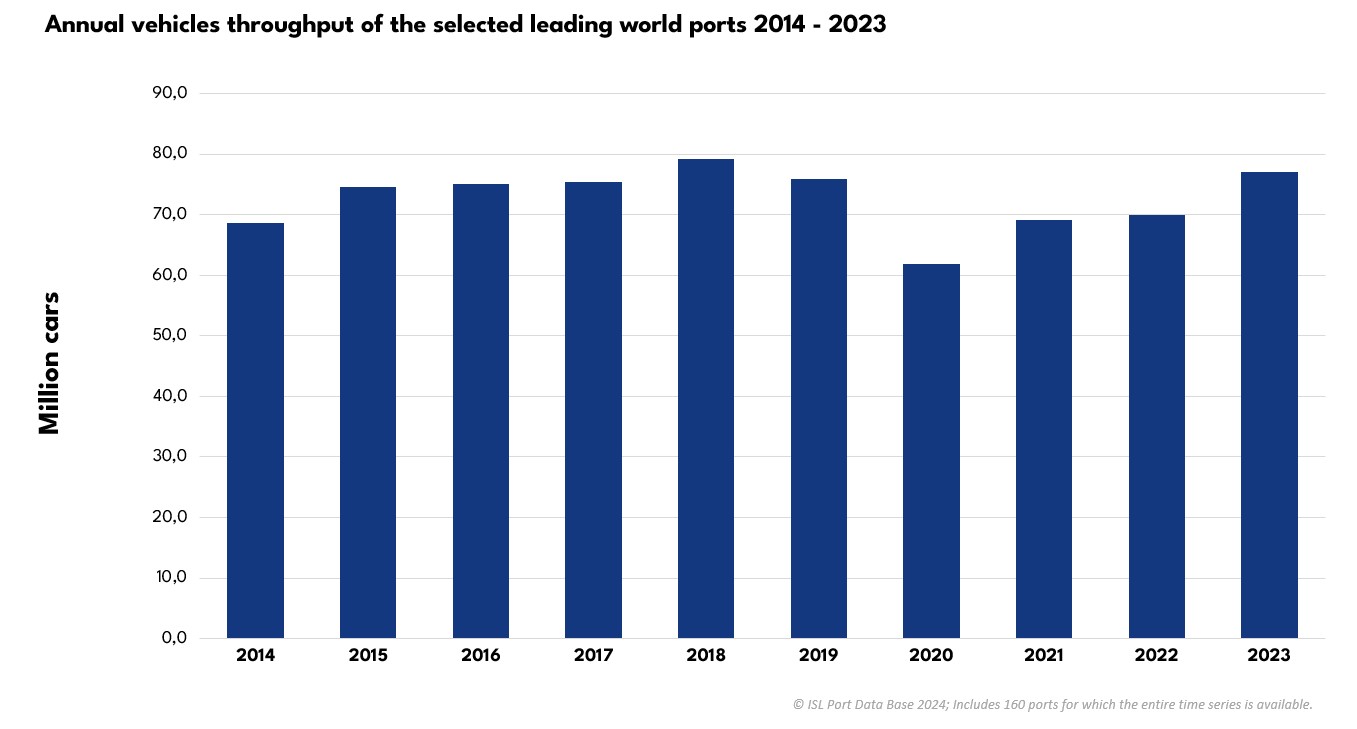

The annual results of the ports that publish their handling results and are included in the ISL Port Data Base also point to a noticeable recovery, after exceptionally difficult years marked by the Covid-19 pandemic. Leading ports showed significant increases in global car throughput.

The car handling figures recorded by ISL totalled 76.8 million vehicles in 2023, which corresponds to an increase in handling of 10.5%. This total is still 2% below the best year to date in 2018, when these ports handled a total of 78 million vehicles.

Only the ports of Bremen/Bremerhaven had to report a further negative result compared to the previous year. While car throughput here fell by 4% from 2021 to 2022, the following year 2023 even saw declines of over 10%. According to officials at the port, this decline is due to economic developments as well as the increasing relocation of production by German manufacturers to the destination countries.

Tokyo (more than 13.5 million vehicles in 2023) and Yokohama (12.2 million vehicles in 2023), by far the world's largest ports in terms of car throughput, as well as Kobe (1.3 million vehicles in 2023), also in Japan and in 10th place, have stabilized their car throughput and are all showing a positive development, which in the port of Yokohama is very clearly above the average of +10.4% with an enormous increase of 21%.

In addition to the Japanese ports, Antwerp-Bruges (+9% to 3.6 million vehicles), Kwangyang, which suffered a handling loss of more than 20% in 2022 (+1.3%/1.4 million vehicles), Nagoya (+9.7%) and the British Grimbsby and Immingham (+18%) are also back on track within the top 20 ports.

Laem Chabang in Thailand and Kocaceli in Turkey also posted positive results. While Laem Chabang increased its car throughput by 21.5% from 1.25 million vehicles to 1.52 million vehicles in 2022, Kokaceli grew by enormous 36 % and achieved its best result ever with 1.58 million vehicles.

The car carrier fleet and the RoRo fleet are of minor importance in terms of their share of the transport capacity of the global merchant fleet, at 0.6% and 0.4% dwt respectively, but are extremely important for the development of the global economy.

Further Information

ISL Webshop: order current SSMR issue

Consequently, the ISL SSMR Issue 5-2024 highlights the current developments around the General Cargo and especially the Car carrier market. It is available via download from our web shop and is sent to our subscribers.

The special feature topics of each SSMR issue are:

- Issue 1: World Merchant Fleet

- Issue 2: Tanker Market

- Issue 3: Bulk Carrier Market

- Issue 4: Container Shipping

- Issue 5: General Cargo and Container Shipping

- Issue 6: Passenger and Cruise Shipping

- Issue 7: Shipbuilding and Shipbuilders

- Issue 8: Major Shipping Nations

- Issue 9: World Seaborne Trade and World Port Traffic