SSMR Vol. 01: The order backlog is at its highest level in 12 years

At the start of 2025, the world merchant fleet consisted of 63,914 vessels with a combined capacity of 2.33 billion dwt, after a year-on-year increase of 3.8 %. The fleet additions were nearly on the same level as during 2023 and reached 1,770 merchant vessels with a combined 86 million dwt. This is equal to a rise of 0.7 % year-on-year in dwt terms. In the same period, just 325 merchant vessels with a combined capacity of 8.6 million dwt have been reported sold for scrap, representing a 13 % year-on-year decrease.

Geopolitical disturbances continue to have a major impact on the development of global seaborne trade. According to the latest figures from Clarkson’s Seaborne Trade Monitor, the volume of maritime trade increased by 2.2% to 12.6 billion tons from 2023 to 2024, following a rise of 2.6% in the previous year; however, the change in terms of tonne-miles was almost three time higher at 6.1%.

The transit volume through the Suez Canal is still 70% below the usual level, with the detour contributing an estimated 3% to total global shipping demand (+12% for container shipping). The relocation of bulk shipments (primarily oil and coal) from the Black Sea as a result of sanctions against Russia due to the war against Ukraine is also continuing to lead to an increase in tonne-miles.

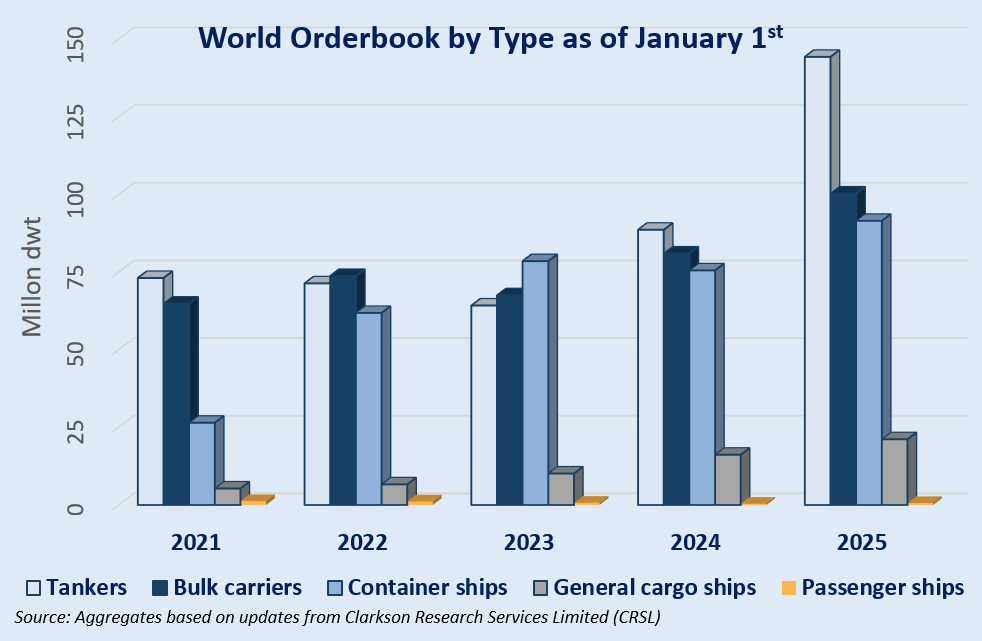

With regard to the order backlog for newbuilds, the record figures from the beginning of 2024 were once again significantly exceeded. At 5,360 ships with a combined capacity of 357.8 million dwt at the start of 2025, the orderbook has grown by 36.7% year on year. Tankers alone make up 40% of this orderbook with a plus of 63%. On the one hand, this confirms the stable market development, but on the other hand, it reflects the increasing average age of the fleet and thus the increasing demolition potential.

Global newbuilding orders also rose sharply last year and even exceeded the high results of 2022, when just under 2,200 ships with 141 million dwt were ordered over the course of the year. This figure was 2,300 units with 356 million dwt in 2024, which represents an increase of 30.5% compared to 2023.

Last year, the LNG/LPG fleet was among the fastest-growing segments after the container fleet (+6.8%), the special cargo fleet (+7.6%) and the car carrier fleet (+7.5%). The fleet grew by 6.8% last year to 2,466 ships with 100 million dwt. The order backlog for liquid gas tankers grew by 14.4% between 2024 and 2025. As a consequence, LNG/LPG tankers now represent 25% of the total order book.

More details about world seaborne trade and the development of the world merchant fleet in the current issue of our SSMR.

Further Information

ISL Webshop: order current SSMR issue

The ISL SSMR 2025-1 looks at world seaborne trade and the development of the world merchant fleet and can be ordered through the ISL webshop.

The special feature topics of each SSMR issue are:

- Issue 1: World Merchant Fleet

- Issue 2: Tanker Market

- Issue 3: Bulk Carrier Market

- Issue 4: Container Shipping

- Issue 5: General Cargo and Container Shipping

- Issue 6: Passenger and Cruise Shipping

- Issue 7: Shipbuilding and Shipbuilders

- Issue 8: Major Shipping Nations

- Issue 9: World Seaborne Trade and World Port Traffic