SSMR Vol. 03: The development of dry bulk shipping is a reliable indicator of the state of the global economy

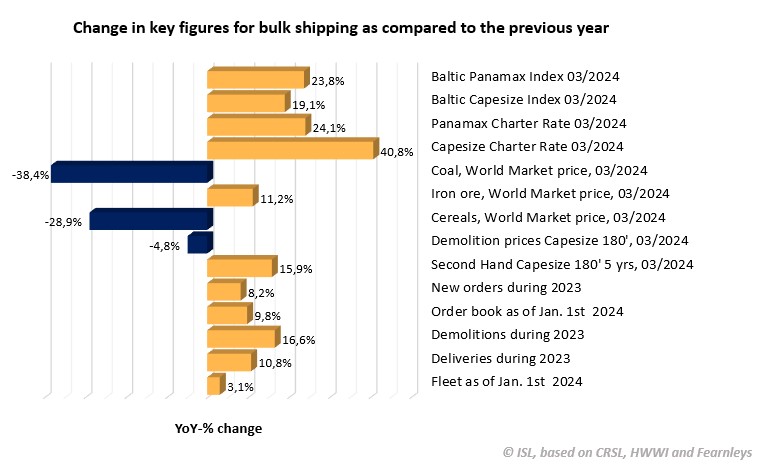

Compared to the first half of the past 12 years, when an average of more than 400 ships were scrapped each year with an average total carrying capacity of 26.5 million dwt per year, the 91 units with a capacity of 5.1 million dwt that found their way to the scrapping yards in 2023 are only slightly more than 20%, although we have nonetheless recorded a 16.6% increase in scrapping in this segment compared to the previous year. It is striking that a total of two thirds of the tonnage comes from the Handymax (22%) and Panamax (44%) size classes.

Nevertheless, the bulk carrier fleet grew by 3.1% between January 2023 and January 2024, which is primarily attributable to the rapid increase in deliveries to the fleet. Last year, 461 new ships (33.6 million dwt) entered service, which corresponds to an increase in deliveries of almost 11%.

The development of maritime trade in dry bulk goods is a reliable indicator of the state of the global economy. While the transport volume of ores, coal and grain fell by a total of 2.8% to 5.3 billion tons in 2022, a significant increase in transport volume of around 3.9% was expected again for 2023, partly due to the economic recovery in China and other important markets. For 2024, experts expect a much lower growth of around 1.2%.

The dry bulk charter market has been on the upswing since the low point in January 2023. The increase was driven in particular by massive growth in capesize vessels, which generally transport 150,000-tonne cargoes such as iron ore, bauxite and coal. Consequently, the Baltic Exchange Capesize Index rose to 2014 points in March of this year, which represents a doubling compared to February 2023.

China, the largest importer, reported a 16.9 % increase in imports in the first quarter of 2024 to an enormous 83.36 million tons. A large proportion of the imports come from Mongolia and Russia and are not transported by sea. According to official reports, domestic production figures also fell slightly.

However, from 2024 onwards, the IEA expects import demand to weaken in the medium term, mainly due to the increased switch to renewable energy sources. The IEA estimates that coal imports will decline by 6.0 % in the three years to 2025 compared with 2022.

Grain volumes are expected to increase slightly in 2024.

Further Information

ISL Webshop: order current SSMR issue

The ISL SSMR 2024-3 highlights various developments surrounding the major dry bulk markets and is available via our Webshop and has just been sent to subscribers.

The special feature topics of each SSMR issue are:

- Issue 1: World Merchant Fleet

- Issue 2: Tanker Market

- Issue 3: Bulk Carrier Market

- Issue 4: Container Shipping

- Issue 5: General Cargo and Container Shipping

- Issue 6: Passenger and Cruise Shipping

- Issue 7: Shipbuilding and Shipbuilders

- Issue 8: Major Shipping Nations

- Issue 9: World Seaborne Trade and World Port Traffic