SSMR Vol. 04: World Container Shipping – good 2024 results, bad outlook

At the start of 2025, the outlook for the container shipping industry is cautious. While last year was still relatively profitable for the container shipping industry despite a variety of problems, experts are projecting a significant drop in revenue for the current year. One of the most important factors in this context is the uncertainty triggered by the US government regarding the development of trade barriers, in particular the sharp increase in trade tariffs.

At the beginning of this year, 6,766 container ships with a combined deadweight tonnage of 363.4 million dwt and 30.8 million TEU were in service. This represents an increase to the fleet of 10.8%.

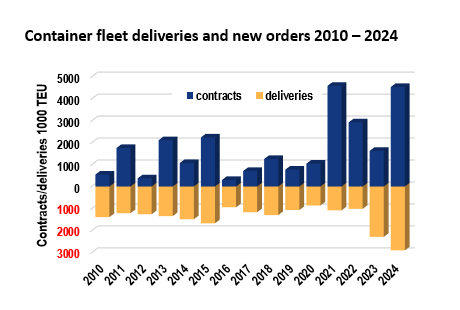

During 2024, 473 vessels totalling 2.9 million TEU were delivered. This corresponds to a remarkable increase of 26.7%. Of these, nearly 45% were units of more than 14,000 TEU capacity. The still high increase in tonnage delivered in 2024 is also reflected in the recent number of laid-up units. According to May 2025 data from Alphaliner, mainly ships in the feeder sector have been temporarily withdrawn from service. According to CRSL, the enormous number of 80 new container ships with a carrying capacity of almost 1 million TEU were ordered in the first quarter of 2025 alone, which is four times the number of the previous year.

According to latest data from ISL’s Port Database, global container traffic was back on track in 2024. After a period of stagnation in throughput volumes from 2022 to 2023, it recovered by 7% in the following year and reached around 793 million TEU in the ports covered by our Port Data Base, around 51 million TEU more than in the previous year.

The growth in container traffic in the major economies indicates that regional economic developments were inconsistent - for example, throughput in the USA recovered after a sharp slump in 2023 and, at 58 million TEU in 2024, was only just below the record figure of 60.1 million TEU in 2022.

According to the RWI/ISL Container Throughput Index, global trade remained robust in the first half of 2025. In May 2025, the index rose to 138.3 points, indicating a continued stable development in global container throughput. In European ports, however, container throughput continued to increase significantly, indicating a possible detour of Chinese exports to Europe.

ISL SSMR 2025-4 highlights the current developments around container shipping. It is available via download from our webshop and will be sent to our subscribers shortly.

The ISL SSMR 2025-4 highlights the outlook for the container shipping industry surrounding the major tanker markets and is available via our Webshop and has just been sent to subscribers.

Further Information

ISL Webshop: order current SSMR issue

The ISL SSMR 2025-2 highlights the outlook for the container shipping industry surrounding the major tanker markets and can be ordered through the ISL webshop.

The special feature topics of each SSMR issue are:

- Issue 1: World Merchant Fleet

- Issue 2: Tanker Market

- Issue 3: Bulk Carrier Market

- Issue 4: Container Shipping

- Issue 5: General Cargo and Container Shipping

- Issue 6: Passenger and Cruise Shipping

- Issue 7: Shipbuilding and Shipbuilders

- Issue 8: Major Shipping Nations

- Issue 9: World Seaborne Trade and World Port Traffic