SSMR Vol. 07: Shipbuilding prices are still at a high level

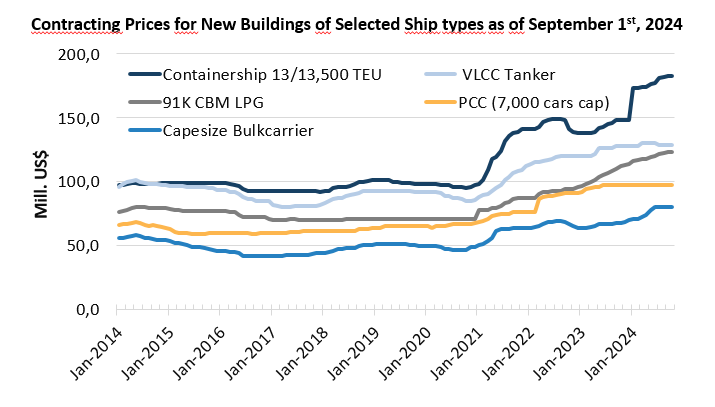

In line with the (currently still) well-filled order books of the shipyards, newbuilding prices for most ship types are at unprecedented levels.

According to the latest figures from BIMCO, prices for new ships have risen to their highest level in 16 years. The US Federal Reserve Bank's Production Price Index by Industry for Shipbuilding and Repair, which measures not only newbuilding prices but also repair costs in the index, even speaks of the highest price level since calculations began more than 30 years ago. This index has risen by 3.2% in recent months.

The prices actually asked for newbuildings, which are recorded by CRSL, have also risen significantly compared to the already high prices in the fall of last year for most ship types.

Prices for the MPP 28,000 dwt/1,700 TEU ship type rose by as much as 20.9% between September 2023 and the same month this year. The prices for large bulk carriers (205-210 KDWT +19.4%), LPG tankers (91,000 CBM, +13.4%) and Ro-Ro freighters (3,500-4,000 lane m. +12.8%) also stand out. Compared to September 2019, prices for these types are even between 36% and 73% higher. According to CRSL, newbuilding prices for large container ships have also risen noticeably again since the slight decline in 2023 and were 25% higher than in September 2023 at an average price of US$ 182.5 million in line with the high demand.

Only the prices for large LNG tankers (174k cbm) and car carriers (7,000 car capacity) remained more or less stable over the course of the year (LNG -1.3%, PCC +/-0%), indicating a certain degree of market saturation, according to Clarksons Research.

With raw material prices remaining very high and construction capacity increasingly concentrated in a few shipyard groups, there is currently little to suggest that construction prices will fall any time soon.

Similar to newbuilding prices, second-hand prices have also seen impressive increases in part. Although the market appears to have calmed down, particularly in the smaller size classes of bulk carriers and tankers. Price increases in the double-digit range of between 10% (28,000 dwt, 5 years old) and 55% (170,000 dwt, 10 years old) can still be observed in the bulk segment, for example. For tankers, the price increases are between 11% and 21% and for large container ships (10,000 TEU, 5 years old) 33%. The only exception here are the average prices for a 10-year-old container ship in the 10,000 TEU size category. These have fallen year-on-year from around US$ 88 million to US$ 68 million.

Further Information

ISL Webshop: order current SSMR issue

The ISL SSMR 2024-7 looks at different developments around shipbuilding and can be ordered through the ISL webshop.

The special feature topics of each SSMR issue are:

- Issue 1: World Merchant Fleet

- Issue 2: Tanker Market

- Issue 3: Bulk Carrier Market

- Issue 4: Container Shipping

- Issue 5: General Cargo and Container Shipping

- Issue 6: Passenger and Cruise Shipping

- Issue 7: Shipbuilding and Shipbuilders

- Issue 8: Major Shipping Nations

- Issue 9: World Seaborne Trade and World Port Traffic