SSMR Vol. 09: The development of global cargo throughput is positive overall

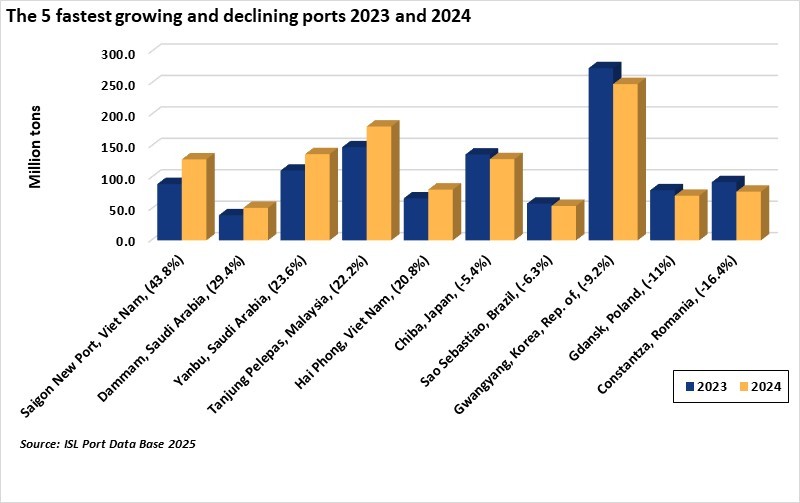

Total cargo throughput of the 470 ports covered by ISL’s Port Data Base rose by 3.4% in 2024, following an increase of 0.5% in 2023. This corresponds to an average throughput growth of 1.7% over the last 10 years, with notable differences across continents. Global container throughput reached a record 792 million TEU in 2024, growing by 7.5% year-on-year, equal to an average growth rate of 2.6% since 2014. The highest growth rates in both total throughput and container throughput were observed in Africa and South America.

More than half of the world ports’ cargo throughput of 23 billion tons was handled in Asian ports. The four most important port nations, namely China, South Korea, Japan and India accounted for two thirds of the Asian market, with shares of 42.3%, 10.9%, 6.5% and 5.7%, respectively, recording a combined throughput of 8 billion tons in 2024.

Port cargo traffic developed differently in the leading East Asian markets. While China, India and South Korea grew by 3.2%, 2% and +0.9%, respectively, Japanese ports declined by 0.3%.

In Europe, the 146 ports included in ISL’s Port Data Base handled 3.4 billion tons of cargo in 2024, up 1.7% compared with 2023, slightly above the 2014 figure. This corresponds to an average annual growth rate of 0.1% over the last 10 years, as disruptions along the Suez Canal and Red Sea routes contributed to schedule variability and feeder network delays.

Meanwhile in Africa, the 69 ports included in the Port Data Base handled 1.3 billion tons of cargo, representing 5.3% of total throughput across the 470 ports covered worldwide. Compared with 2023, port traffic increased by 7.2%. In North America, the 69 ports covered by the ISL Port Data Base handled 2.61 billion tons of cargo in 2024, an increase of 10.6% year-on-year.

Total cargo of 1.4 billion tons handled by the 50 South American ports was four times higher than in Central America, reflecting the dominance of large-scale bulk exports and major gateway ports in South America. In Central America, transshipment plays an important role in a highly contested market that regularly experiences market-share shifts. In 2024, Lazaro Cardenas increased by 28.8% to 2.40 million TEUs, following a decline of 7.8% in 2023.

The ISL SSMR 2025-9 looks at the world maritime trade and the development of the ports involved; The issue is currently being sent to subscribers and can be ordered via our web shop.

Further Information

ISL Webshop: order current SSMR issue

The ISL SSMR 2025-9 highlights the world maritime trade and the development of the ports involved and can be ordered through the ISL webshop.

The special feature topics of each SSMR issue are:

- Issue 1: World Merchant Fleet

- Issue 2: Tanker Market

- Issue 3: Bulk Carrier Market

- Issue 4: Container Shipping

- Issue 5: General Cargo and Container Shipping

- Issue 6: Passenger and Cruise Shipping

- Issue 7: Shipbuilding and Shipbuilders

- Issue 8: Major Shipping Nations

- Issue 9: World Seaborne Trade and World Port Traffic