SSMR Vol. 09: Stagnating development in global ports’ throughput

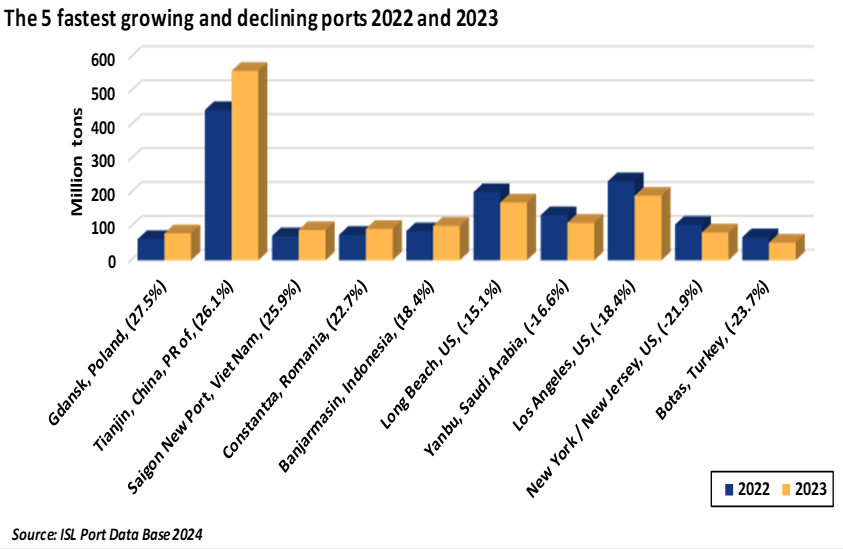

Total cargo throughput of the 470 ports covered by ISL’s Port Data Base increased by 0.2% in 2023 after a decrease of just under one percent in 2022. This results in an average throughput growth of 1.2 % over the last 10 years – with considerable differences between the continents. Worldwide container handling reached 733.6 million TEU compared to 733.3 million TEU in 2022, equal to an only small decrease of less than 0.1%.

The countries of Northeast and Southeast Asia are the industrial manufacturing centre of the world. More than half of the world ports’ cargo throughput (22 billion tons) was handled in Asian ports. The four most important port nations, namely China (22.7%), and – at a distance – South Korea (6%), Japan (3.6%) and increasingly India (3.1%) account for more than two thirds of the Asian market. They recorded a combined port throughput of 7.8 billion tons in 2023.

The total weight of cargo handled in the 146 European ports included in ISL’s Port Database reached about 3.7 billion tons in 2023, a slight decrease (-2.7 %) compared to 2022 and only slightly above the 2014 level.

According to latest data from our Port Data Base, the three leading Dutch ports (Rotterdam, Amsterdam, Flushing) reported a combined throughput of just over 556 million tons in 2023 (-7.9% compared to 2022), which corresponds to around 15.0% of total European port throughput, making the Netherlands the top-ranking European country.

In 2023, the 69 North American ports in ISL’s Port Database achieved a total throughput of approximately 2.37 billion tons, a decrease of -5.5 %. Compared to 2018 – the record year preceding the Covid-19 pandemic – this result represents a decrease of -2.7 %.

Only 10 of the top 60 ports in South and Central America in the ISL Port Database mainly handle containers and other general cargo such as cars, whereas almost twice as many are classified as bulk cargo ports. As a result, the share of bulk goods in the total throughput of 1.5 billion tons of the 64 ports in this region is particularly high at 71%.

With a total handling volume of 1.2 billion tons, the 68 African ports included in our Port Database achieved a market share of approximately 5.3% of the throughput of all ports included worldwide. Compared to 2022, their traffic increased by 4.8%. This development is significantly better than the world average.

Half of the continent’s top 10 ports are on the northern coasts: the Moroccan ports of Jorf Lasfar and Tangier, and the Egyptian ports of East Port Said, Alexandria/El-Dekheila and Damietta.

More details about the world maritime trade and the development of the ports involved can be found in the current issue of our SSMR.

Further Information

ISL Webshop: order current SSMR issue

The ISL SSMR 2024-7 looks at different developments around shipbuilding and can be ordered through the ISL webshop.

The special feature topics of each SSMR issue are:

- Issue 1: World Merchant Fleet

- Issue 2: Tanker Market

- Issue 3: Bulk Carrier Market

- Issue 4: Container Shipping

- Issue 5: General Cargo and Container Shipping

- Issue 6: Passenger and Cruise Shipping

- Issue 7: Shipbuilding and Shipbuilders

- Issue 8: Major Shipping Nations

- Issue 9: World Seaborne Trade and World Port Traffic